We all want to know “how we are doing” with our investments. Investors want some sort of guideline to compare their own portfolios’ performance with, so they tend to compare their performance to the performance of a market index.

Many people don’t realize, however, that benchmarking to an index doesn’t make sense for most investors. Also, the indexes may not represent the overall market or economy. Right now, for example, even though the S&P is up, this is due to just a few stocks. If you were to take these stocks out, the market is actually down year to date!

Here are four reasons why we do not recommend looking at the indexes to assess the performance of your own portfolio.

1. Your Portfolio’s Holdings Don’t’ Match the Indexes’ Holdings

Still, investors want some sort of benchmark when assessing the performance of their personal investments, so they tend to compare their portfolios’ performance to that of an index, such as the Dow and the S&P 500.

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks 30 large, publicly owned blue-chip companies trading on the New York Stock Exchange (NYSE) and Nasdaq. The Standard & Poor’s 500 (known as the S&P 500), is a stock market index that includes the 500 largest companies (in terms of total market capitalization) listed on the New York Stock Exchange or NASDAQ.

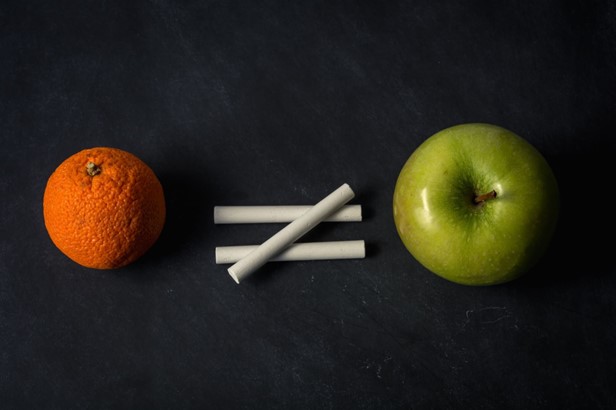

Although these indexes provide us with useful information about how the broader market is performing, they are not so useful for understanding how your own personal portfolio is performing. This is because the holdings in your portfolio are not necessarily the same as those in the index.

For example, if your portfolio consists of 75 percent stocks and 25 percent bonds, you cannot make an “apples-to-apples” comparison with either the Dow or the S&P 500 because both of those major indexes consist entirely of stocks. Even if you had an all-stock portfolio, you likely would own some small-company stocks, which would not be represented in the Dow because it contains just 30 large-company stocks. And if you owned stocks of non-U.S. companies, these would not be included in the S&P 500, which is made up of 500 large U.S. companies.

Your portfolio may include fixed-income, international or small-cap equity stocks that are not part of these indexes.

The diversification in your portfolio may be of benefit to you over the long term.in reducing volatility; but it will produce differences in the relative performance of your portfolio in the short term.

2. Different Companies Make Up the Indexes Over Time

Another reason why investors need to be careful about comparing their own portfolios’ performance to an index is that the companies that make up the indexes are always changing, based on performance. The 30 companies that compose the Dow are not always the same ones. Similarly, the 500 companies that compose the S&P 500 are not always the same ones.

In fact, if you compare the list of the top 10 companies names in the S&P 500 now versus 20 years ago, do you know how many companies made both lists? Just one — Exxon Mobil. It’s the only corporation in the United States that made the list in both 2003 and 2023.

However, even though most of the names on this index have changed, most investors are still allocating to a cap-weighted S&P 500 fund. This means they are, in essence, betting on the continuance of existing trends in the market — betting that the same large names will continue to generate strong returns.

3. The Markets Have Become Concentrated

A third reason why benchmarking doesn’t make sense for most investors is that the S&P 500 is now more concentrated than it has been in decades. For example, Apple and Microsoft now represent more than 15 percent of the overall S&P 500 index. If you add Nvidia, Facebook, Google and a few of the larger technology companies, fewer than 10 stocks represent more than 30 percent of the market cap of the entire index.

All the indicators — including the advance/decline line, the new highs and new lows list and stocks above or below relevant moving averages — show there is not a lot of participation.

Overall, the top 10 companies in the S&P 500 have accounted for as much as 35 percent of the index’s market cap in recent months. This concentration can leave your portfolio vulnerable to potential losses if interest rates remain high and stock values decline.

The market has been very narrow in terms of performance. The S&P 500 is market cap weighted. It is up approximately 9.5 percent year to date, but the equal weight S&P index is actually negative year-to-date.

We constantly screen the underlying holdings within our investment committee. We look at how funds are doing relative to their peer group, rather than the S&P 500, when so few companies are responsible for most of the gains. The S&P is generally a good index to compare the stock portion of your portfolio over time, but the comparison will lose some of its relevance in a portfolio that is composed of both stocks and bonds. Historically, reducing bond market exposure will increase performance, but it will also increase volatility.

4. Market Indexes Aren’t Relevant to Your Personal Vision

Finally, benchmarking to market indexes doesn’t make sense because market indexes do not take into consideration your personal vision, lifestyle and financial goals.

The most important benchmark is whether you can maintain and enhance your standard of living, not some market index. Your investment strategy needs to focus on your needs, wants and vision — not a random number or value. Moreover, the index performance does not take into consideration your tax status.

We focus on you and achieving your vision. Rather than taking an investment-centric approach that looks at the portfolio and tries to determine how your life can be, we want to understand what your personal vision is for the future and then develop a holistic plan to achieve it. The investments themselves are simply a means to an end. We call this Personal Vision Planning®.

Why are you investing? Is it to beat an index or to achieve a personal goal? Is it to select the newest investment or to live your dream? As we face volatile markets, portfolio fluctuations and dire news, we often focus on the value of our accounts, not the value they bring. If we can meet

our goals today and tomorrow, then the absolute numbers really don’t matter. Our team is here to help you do just that — meet your personal goals now and in the future.

________

One cannot invest directly in an index. Past performance does not guarantee future results. Investing involves risk regardless of the strategy selected.

Randy Carver, CRPC®, CDFA®, is the president and founder of Carver Financial Services, Inc., and is also a registered principal with Raymond James Financial Services, Inc. Carver Financial Services, Inc., was established in 1990 with the vision of making people’s lives better — clients, team and community. With this mission, Carver Financial Services has grown to be one of the largest independent financial services offices in the country, managing $2.3 billion in assets for clients globally, as of March 2023. You can reach Randy directly at randy.carver@raymondjames.com and in the office at (440) 974-0808.