As we look ahead toward 2026, the coming midterm elections will draw significant attention — and likely a fair amount of market speculation. History shows that while midterms often introduce volatility, they have also been followed by some of the strongest 12‑month returns in market history.

As we enter a new election cycle, many investors understandably begin to feel the familiar rhythm of speculation. Midterm years have historically introduced more volatility, and we expect 2026 to follow that pattern. Even so, the underlying economy remains strong, and any possible correction is something we view not as a threat, but as an opportunity to rebalance, tax-loss harvest, and strengthen portfolios for the next leg forward.

Why Midterms Matter — But Maybe Not in the Way You Think

- Midterm elections — when Congress (House and part or all of the Senate) is on the ballot — often lead to changes in legislative control. That means potential shifts in fiscal policy, taxation, regulation, and spending priorities. (U.S. Bank)

- With control up for grabs, policy uncertainty often rises leading into midterms — and that uncertainty tends to translate into market volatility. (Raymond James)

- That volatility isn’t just noise: according to some studies, the pre-midterm period tends to underperform. (U.S. Bank)

But while the run-up can be rocky, the period immediately after midterms—and the ensuing 12-month window—has historically favored investors.

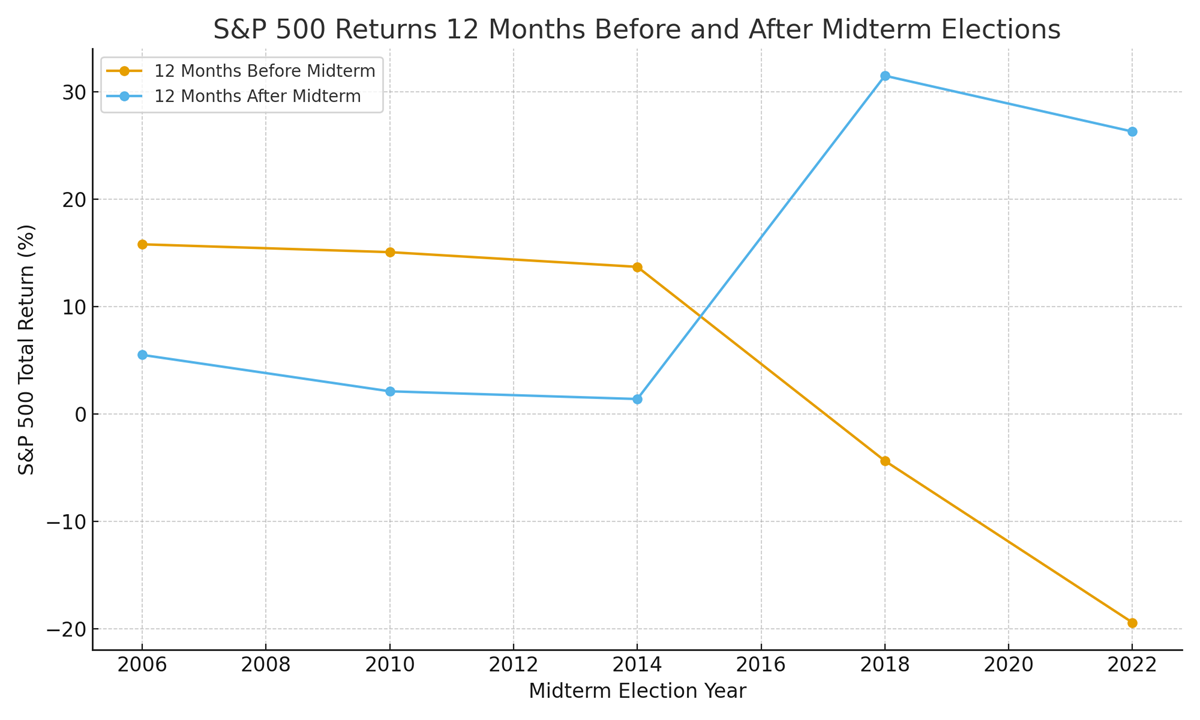

Below is a chart illustrating S&P 500 performance during the 12 months before and after the last several midterm elections. This visual underscores a historical trend: pre‑midterm uncertainty often gives way to strong post‑election recoveries. (source S&P.com)

Looking back across decades of midterm cycles reveals a fairly consistent “tug-of-war + recovery” pattern:

| Period | Historical Pattern (Post-Adjustment) |

| 12–18 months before midterms | Elevated volatility, often a market pullback — drawn-out uncertainty over fiscal/regulatory direction. (MarketWatch) |

| Intra-year during midterm years | On average, deeper intra-year declines than non-midterm years. (Baird Wealth) |

| 0–12 months after midterms | Historically strong rebound and outperformance: markets tend to “breathe easy” once uncertainty resolves. (U.S. Bank) |

In fact, over many midterm cycles, once who controls Congress becomes known and policy clarity improves, equities tend to rally — regardless of which party wins. The market historically dislikes uncertainty, but once results clarify the political landscape, markets often rebound as businesses and investors gain greater clarity.

Periods of discomfort often precede renewed strength:

- 2018 (midterm year) : S&P 500 declined ~6.2%

- 2019: Rebounded with a 31.5% gain

- 2022 (midterm year) Fell 19.4% amid inflation and rate hikes

- 2023: Surged 24.2% as inflation cooled and earnings held firm

Over many cycles, the months following midterms have delivered strong, consistent returns. Politics may shift, but a well-constructed plan endures.

Our commitment remains the same: staying disciplined, viewing volatility as opportunity, and positioning our clients beyond any short-term noise.

So What Should Investors Do Going Into 2026?

At Carver Financial, as we think about 2026 and how to position portfolios, here’s our playbook — rooted in history, but grounded in what we know today:

- Expect elevated volatility between now and election day. With Congress on the line, policy uncertainty will likely drive short-term swings.

- View dips as potential entry points, not reasons to panic. Historically, many of the sharper pre-midterm declines turned into attractive buying opportunities once volatility settled.

- Stay diversified. Because midterms can affect sectors differently (depending on who wins, which House flips, policy shifts), a well-balanced portfolio can help guard against undue sector-specific swings.

- Don’t bet on which party wins. Markets historically have performed well regardless of whether a single party dominates or there’s a divided government. (Investopedia)

- Align investing decisions with long-term goals, not short-term noise. Use the “Personal Vision” lens: focus on what your clients want to accomplish over 5, 10, 20 years — not just what the political headlines say this month.

The Bottom Line: Midterms Bring Uncertainty — but Also Opportunity

Yes — midterm election years tend to come with more volatility, potentially deeper drawdowns, and a lot of media noise. That’s reality. But history also depicts a strong underlying tendency: once the votes are counted and Congress’s shape is known, markets have repeatedly rebounded and posted healthy returns over the following 6–12 months.

2026 will almost certainly prove no different. The key is to remain disciplined, diversified, and forward-looking. If you build portfolios around fundamentals — not headlines — you give yourself the best chance to benefit from the cycle rather than get derailed by it.

At Carver Financial, that’s our anchor. And we believe strongly: politics may change, but a well-constructed plan endures.

Randy and his team manage $3.5 Billion in assets for clients globally. Randy has more than 35 years of experience in the financial services industry. You can reach Randy at (440) 974-0808 or randy.carver@raymondjames.com.

Any opinions are those of Randy Carver and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

You can contact us at randy.carver@raymondjames.com or (440) 974-0808.

Any opinions are those of Randy Carver and not necessarily those of Raymond James.

7.31.26 37th Annual Client Appreciation Event

7.31.26 37th Annual Client Appreciation Event