There are many reasons to feel stressed and anxious these days, especially when it comes to the economy and investments. Between the growing unrest in Europe, endless COVID-19 waves and rising inflation, it can feel impossible to catch a break. The incessant negative news from the media reinforces all of this.

As with anything in life, there is always going to be a mixture of good and bad. The important thing is to avoid focusing solely on the bad. Any decision made out of fear may cause problems further down the line. Moreover, if we have incomplete or simply false information, our decisions are likely to be wrong.

Let’s look at a few facts.

1. Today’s Volatility Is Not New

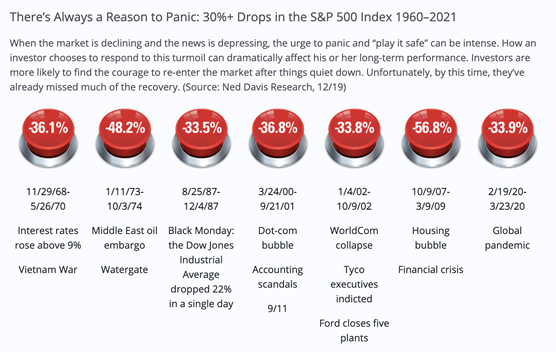

In March 2022, Harford Funds published a chart that displays some of the market dips of 30 percent or more in the S&P 500 Index drops over the past 61 years.

2. Panic could cost you in at least three ways

Market drops are normal. From January 1, 1980, to December 2021, the S&P 500 Index saw average annual drops of 14 percent, yet the average return over that period was 9.4 percent per year. With that in mind, let’s look at three ways that panic could cost you.

A. Focusing on the negative, which leads to fear

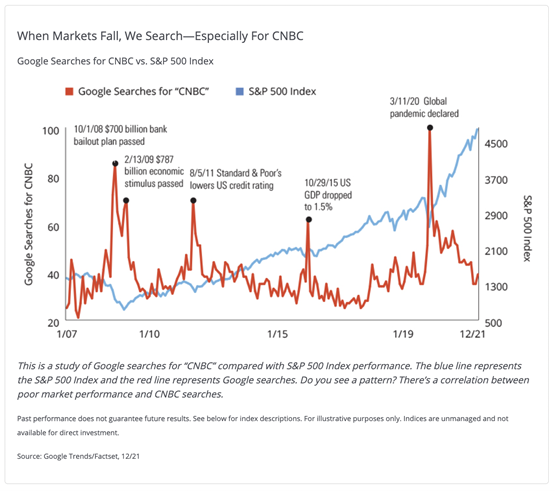

According to Newsweek, many cable news networks saw a dramatic increase in ratings during their 24/7 Coronavirus coverage. As shown in the chart below, from March 16–20, Fox News saw its ratings climb 89 percent over the same time last year, to 881,000 primetime viewers per day ages 25–54. CNN was up 193 percent to 790,000 and MSNBC climbed 56 percent to 570,000.

Making decisions based on fear creates a self-fulfilling market prophecy — more people are watching the news, which means more people are seeing examples of stories that can cause market instability, which gives them anxiety and could lead to fear-based investment decisions. This kind of mindset is contagious.

As Hartford Funds so accurately puts it, “When we’re anxious, we’re more likely to allocate our attention to negative information. Given the choice between information that may offer an optimistic perspective or data that paints a bleak future, an anxiety-influenced investor may naturally focus on threatening information.” When investors focus on that information, they tend to “play it safe” with their investments, potentially losing out.

B. Playing it safe

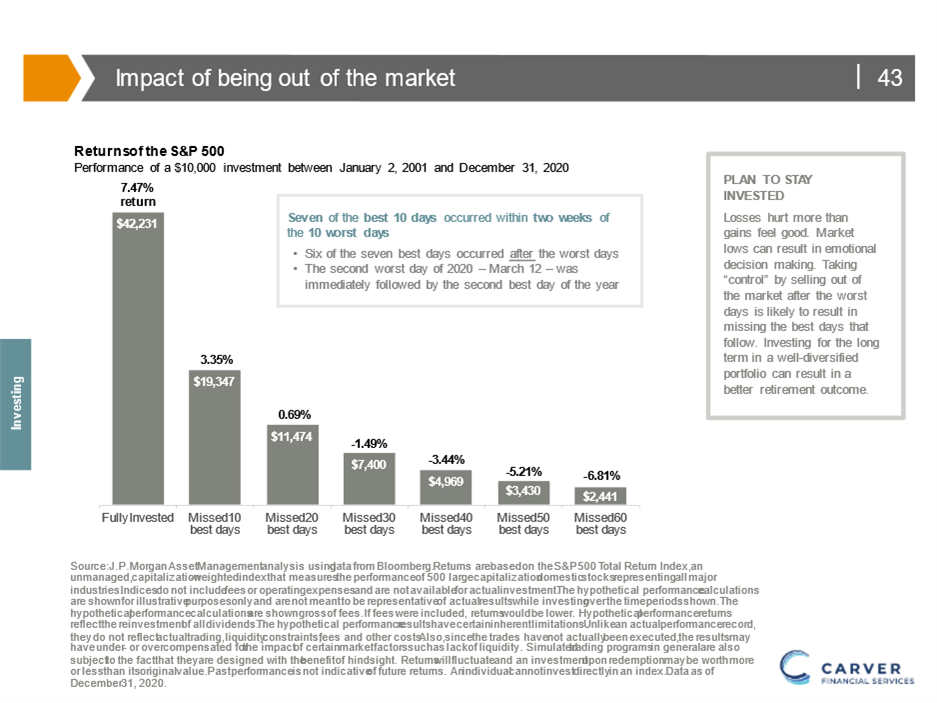

When a person senses instability, the natural instinct is to do everything possible to cultivate protection. This may mean moving to cash or fixed income. The problem with either action is that often, the best days in the market are within a week or two of the worst days, and you miss them. Missing just a few days can result in permanent loss.

In the two decades from 2001 to 2021, we experienced three bull markets and three bear markets, along with the terrorist attacks in 2001, the financial crisis in 2008 and the COVID-19 pandemic of 2020–22. Yet despite these unprecedented events, the S&P 500 still managed to generate a total annual return of 8.06 percent with reinvested dividends. The total return over this period was 409.13 percent. This means that a $10,000 investment made at the beginning of 2001 would have been $50,913.05 by the end of 2021.

Some investors move to bonds in an effort to avoid losses. However, moving to bonds not only may cause you to miss market returns but also to lose value in the bonds themselves. As interest rates rise, bond prices will drop. For the first time in several decades, we are seeing interest rates rise. The chart below shows how being out of the market could impact your portfolio.

C. Losing perspective — our economy is strong

When people feel panic setting in, they tend to change their behaviors to try to alleviate that feeling. As mentioned, this reaction or a focus on inflated safety can contribute to the loss of gains when the market does recover.

It is also common for individuals to see the market dropping and decide to abandon their overall plan to “stop the bleeding” and then wait for things to get better. This is market timing, and it doesn’t work.” As we have said previously, by trying to time the market, you potentially miss out on rallies. There is endless research out there proving that investors who try to time the market by hopping in and out of investments when the going gets tough often fail. It’s impossible to pick the accurate moment to dive in or pull out. We’re here to encourage you to maintain your perspective and to have a plan in place for when you need short-term cash and long-term cash.

Today the markets and economy are relatively strong. We are facing the headwinds of higher interest rates and inflation; however, overall earnings for companies remain strong. Moreover, as we have more uncertainly in Europe, the Middle East and even Canada, more funds will be directed to the United States. It has been said that our government is dysfunctional but stable.

According to the Bureau of Labor Statistics, the U.S. GDP grew 5.7 percent in 2021 after decreasing 3.4 percent in 2020, and GDP reached almost $23 trillion in 2021. This is the highest GDP growth rate in 37 years.

Thanks to stimulus checks, unemployment insurance and the Child Tax Credit, Americans have an average of 50 percent more money in their bank accounts than before the pandemic. Overall, wages are up, increasing by as much as 11 percent in some sectors. Unemployment has fallen to an astonishing 4.6 percent, back down to pre-pandemic levels. In the midst of a global pandemic, 11 million people were lifted out of poverty in 2020.

Corporate earnings numbers for Q1 2022 have been great. Right now, figures reflect S&P 500 earnings per share, tracking to a 31 percent year-over-year increase. (Yahoo! News) Now, of course this is all easier said than done. However, there are some helpful charts and years of data to show why what we are seeing is not new and also why panic may lead to very poor decisions.

3. There is opportunity in the market downturns

What many people don’t realize is that uncertainty can actually create opportunity for those who take advantage of the situation.

In one of our 2021 blog posts, “Volatility Is Our Friend,” we discussed strategies investors can use to benefit from volatility, including tax swaps and rebalancing from equity to fixed income or vice versa. Our team can help you discover and leverage the opportunities that are inherent in market downturns.

As Winston Churchill said, “Never let a good crisis go to waste.”

________

Ultimately, it’s impossible to manage your emotions in a vacuum. The media are almost solely focused on the negative. There have always been pandemics, geopolitical events and concerns about the economy, going back 1,000 years. The one thing that has changed is the volume of information we are exposed to.

Our team is here to help you make decisions based on facts and needs — not emotions or panic. With more than 250 years of combined experience, our team is here for you. It’s likely the news will get worse and markets will be volatile. Our Personal Vision Planning® process takes into account the unforeseen. Feel free to reach out to us any time. Your vision is our priority.

________

Randy Carver, CRPC®, CDFA®, is the president and founder of Carver Financial Services, Inc., and is also a registered principal with Raymond James Financial Services, Inc. Randy has more than 32 years of experience in the financial services business. Carver Financial Services, Inc,. was established in 1990 and is one of the largest independent financial services offices in the country, managing $2.2 billion in assets for clients globally, as of December 2021. Randy and his team work with individuals who are in financial transition as a result of divorce, retirement or the sale of a business. You may reach Randy at randy.carver@raymondjames.com.

The information contained in this post does not purport to be a complete description of the securities, markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Randy Carver and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations are shown gross of fees. If fees were included, returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs.

Also, because the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index.

Preserving & Passing: An Asset Protection & Estate Planning Event

Preserving & Passing: An Asset Protection & Estate Planning Event